Arizona businesses are tapping into wellness programs to encourage healthy behaviors among employees and ultimately to save money.

Both small and large companies are looking into wellness programs for their employees because regardless of the size, trade and other defining characteristics of companies, wellness programs can be effective.

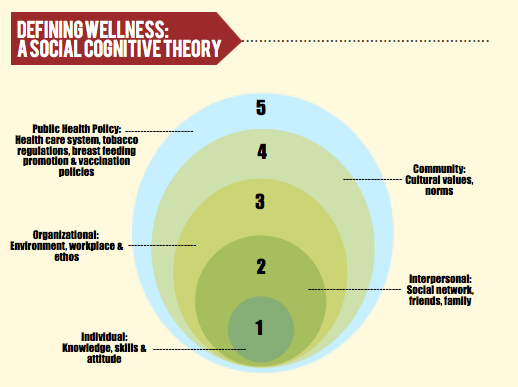

The varying definitions of what it truly means to be a healthy individual has made it difficult to quantify statistics that show the benefits of implementing a wellness program.

“I think businesses are acting in good faith and that they have the belief that these things work, but we still lack good evidence on what really works and what doesn’t,” said Dr. Joe Gerald, an expert in the economic evaluation of health interventions and an assistant professor in the UA Mel and Enid Zuckerman College of Public Health.

According to Gerald, it is theoretically possible to put a price on modifiable behaviors vs. saying it is definitely true that if an employee commits a specific behavior then it will lead to or avert a specific health condition.

“For the folks who are implementing workplace wellness programs, I think that their hearts are in the right place and for those who can align their company’s benefits and profits with their employee’s health are the ones that offer the best opportunities.”

Wellness programs can target a variety of different health factors and offer different incentives based upon the health behaviors being targeted. For example, if a business wants to target smoking behaviors among its employees, the majority of employees would not object to workplace policies that make strict regulations on smoking status because only about 20 percent of Americans smoke.

“We spend about 60 percent of all our healthcare dollars on the care of people in hospitals. If we can avoid these costly events, the idea is if insurance companies don’t spend that money on healthcare services, that money can be returned to the company or employees in the form of lower premiums,” Gerald said.

For many companies, avoiding higher premiums means encouraging preventative healthcare and avoiding any circumstance that would lead to an employee ending up in the hospital.

Another example of a business wellness program is one that targets employees with asthma and encourages proper treatment. To reduce the number of employees admitted to the hospital with asthma-related problems, a business might offer to pay the employee’s $15-30 co-pay required for their medication. Then the employee will be more likely to pick-up their medication and take it, then be less likely to incur high hospital costs. When a company effectively encourages its employees with asthma to take their medication, they greatly reduce the company’s risk of an increase in premiums.

In 2007, a self-insured Tucson manufacturing company with 93 employees, faced a financial crisis that stemmed from rising costs of employee health care claims. Confronted by the looming prospect of going out of business, R.E. Darling prioritized its health goals and restructured the nuts and bolts of their employee health care plan by implementing an employee wellness program.

“We just started thinking about how we could lower our healthcare costs,” said Lynn Cosgrove, human resources specialist at R.E. Darling. “‘It was like “ah-ha!” If we make our people healthier and educate them more, then they will go to the doctor less or only when they really need to.”

Cosgrove also imagined that by improving the health of R.E. Darling’s employees, it would also move the company toward its overarching goal of eventually being able to join a fully insured health care plan.

“Before we started focusing on employee health, we didn’t have a health care deductible, so we made one at $1,000 to start with. If people participated in our wellness plan they could earn the money back—a little carrot and stick,” Cosgrove said.

Creating a wellness program requires an intensive assessment of the company’s characteristics and defining qualities.

“It’s important what the program is, the behavior it’s targeting, the effectiveness of that program at accomplishing what it’s trying to achieve, and then how well those improvements translate into greater work productivity on the job,” Gerald said.

Envisioning an ideal wellness plan for R.E. Darling’s employees meant making sure the plan “screamed wellness.” R.E. Darling turned to Daniel Johnson, the executive director of the Wellness Council of Arizona, for assistance in developing a wellness program.

While Cosgrove acknowledges that the company could have potentially run a wellness program on their own, she doubts the success of it due to their lack of time and resources.

According to Johnson, small businessowners typically have a hard time influencing their insurance costs because there are not enough employees who have premiums to cover the cost of care. On top of that, there are also some employees who no matter what they do in their lifestyle, their blood pressure is not going to achieve a normal level. Incentives like a wellness program can encourage these employees to take medication and they can certainly maintain a normal blood pressure level in doing so.

Encouraging a healthy lifestyle for employees means promoting more physical activity, better nutrition choices, taking new avenues to better manage stress and paying attention to self-care.

“We look at if somebody is high risk meaning are they outside the limits of what the average reading is supposed to be,” said Cosgrove.

“We look at if somebody is high risk meaning are they outside the limits of what the average reading is supposed to be,” said Cosgrove.

To address these risk factors, biometric testing was completed with each employee, along with a wellness coach meeting to set goals tailored to that individual’s health risks.

At the beginning of the program, the company had six employees who were high risk in all six of the categories–today, the company has zero.

“Part of our overall wellness goal was to get everyone down to having less than two risks and today we have 21 people who have zero risks,” said Cosgrove.

And while R.E. Darling initially did not see extensive reductions in claims, after two years their claims went from nearing $1 million to between $200,000 and $300,000.

“We accomplished exactly what we wanted to in two years,” said Cosgrove. “Our people got healthy and when we got quotes they were a fixed expense (not fluctuating) so we were able to jump onto a fully insured plan last year. We succeeded.”